A low ratio may indicate issues with collection practices, credit terms, or customer financial health. Automation can speed up your AP process, as well as keep you up-to-date on payments, due dates, and a centralized place for all your bills. When you purchase something from a vendor with the agreement to pay for the purchase later, you make an entry into your accounting system debiting an expense and crediting accounts payable. Our partners cannot pay us to guarantee favorable reviews of their products or services. But in the case of the A/P turnover, whether a company’s high or low turnover ratio should be interpreted positively or negatively depends entirely on the underlying cause. Here’s an example of how an investor might consider an AP turnover ratio comparison when investigating companies in which they might invest.

Ways to Lower AP Turnover Ratio

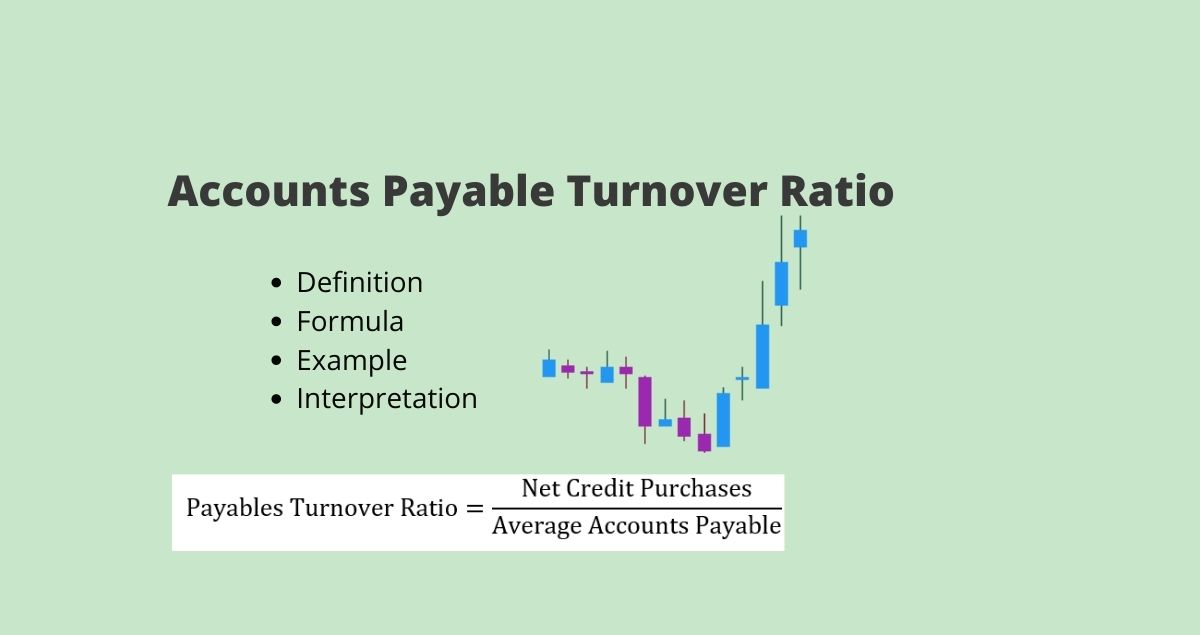

The formula for calculating the accounts workflowmax job and project management software divides the supplier credit purchases by the average accounts payable. Your accounts receivable turnover ratio is also an element that will have an impact on your company’s accounts payable turnover ratio. However, it should be noted that this metric cannot directly be compared across different industries or company sizes. Many variables should be examined in conjunction with accounts payable turnover ratio. However, if calculated regularly, an increasing or decreasing accounts payable turnover ratio can let suppliers know if you’re paying your bills faster or slower than during previous periods. The best way to determine if your accounts payable turnover ratio is where it should be is to compare it to similar businesses in your industry.

- Accounts receivable turnover ratio is another accounting measure used to assess financial health.

- A high ratio indicates that a company is managing its creditors effectively and is more likely to have access to credit and financing on favorable terms.

- That means the company has paid its average accounts payable balance 6.25 times during that time period.

- It’s essential to compare the AP turnover ratio with industry benchmarks or historical data to assess performance relative to peers or previous periods.

- If you decide to compare your accounts payable turnover ratio to that of other businesses, make sure those businesses are in your industry and are using the same standards of calculation you are.

Track & Analyze AP Turnover and Other AP Metrics in Real-Time

For example, an ideal ratio for the retail industry would be very different from that of a service business. Unlike many other accounting ratios, there are several steps involved in calculating your accounts payable turnover ratio. Another important component to consider when calculating the Accounts Payable Turnover Ratio is the payment terms negotiated with suppliers. Payment terms can vary from supplier to supplier and can have a significant impact on the ratio. For example, if a company negotiates longer payment terms with its suppliers, it may have a lower turnover ratio as it takes longer to pay off its accounts payable.

Example of How to Secure Good AP Turnover Ratio

Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. The following two sections refer to increasing or lowering the AP turnover ratio, not DPO (which is the opposite). Add the beginning and ending balance of A/P then divide it by 2 to get the average. This shows that having a high or low AP turnover ratio doesn’t always mean your turnover ratio is good or bad. Below 6 indicates a low AP turnover ratio, and might show you’re not generating enough revenue. Moreover, the “Average Accounts Payable” equals the sum of the beginning of period and end of period carrying balances, divided by two.

How to Compare Your Company’s Accounts Payable Turnover Ratio with Industry Averages

By benchmarking with industry statistics and doing some internal analysis, you can decide when it’s the best time to pay your vendors. Your company’s accounts payable turnover ratio (and days payable outstanding) may be considered a higher ratio or lower ratio in relation to other companies. Improve your accounts payable turnover ratio in days (DPO) by lowering the days payable outstanding to the optimal number that meets your business goals. The accounts payable turnover ratio is a financial metric that measures how efficiently a company pays back its suppliers. It provides important insights into the frequency or rate with which a company settles its accounts payable during a particular period, usually a year.

To calculate the average accounts payable outstanding, you can add the beginning and ending accounts payable balances and divide the sum by two. Calculating the AP turnover in days, also known as days payable outstanding (DPO), shows you the average number of days an account remains unpaid. The formula for calculating the AP turnover in days is to divide 365 days by the AP turnover ratio.

A low ratio may indicate slower payment to suppliers, which can strain relationships and affect credit terms. Before delving into the strategies for increasing the accounts payable (AP) turnover ratio, let’s understand the reasons behind the need for such adjustments. Your payables turnover ratio can be improved by implementing an automated AP software.

Note that higher and lower is the opposite for AP turnover ratio and days payable outstanding. For example, if the accounts payable turnover ratio increases, the number of days payable outstanding decreases. If you pay invoices quicker than necessary, you’re either paying short-term loan interest or not earning interest income as long as you can on your cash balances. Have you thought about stretching accounts payable and condensing the time it takes to collect accounts receivable? If you do, you want to be sure that your business treats vendors reasonably well.

The inventory paid for at the time of purchase is also excluded, because it was never booked to accounts payable. Given the A/P turnover ratio of 4.0x, we will now calculate the days payable outstanding (DPO) – or “accounts payable turnover in days” – from that starting point. The Accounts Payable Turnover is a working capital ratio used to measure how often a company repays creditors such as suppliers on average to fulfill its outstanding payment obligations. The investor can see that Company B paid off its suppliers at a faster rate than Company A. That could mean that Company B is a better candidate for an investment. However, the investor may want to look at a succession of AP turnover ratios for Company B to determine in which direction they’ve been moving.

In short, accounts payable (AP) represent the money you owe to vendors or suppliers. Accounts payable appears on your business’s balance sheet as a current liability. Calculating the accounts payable ratio consists of dividing a company’s total supplier credit purchases by its average accounts payable balance. With AP automation, companies gain better visibility and control over their cash flow.